Dear disgruntled reader:

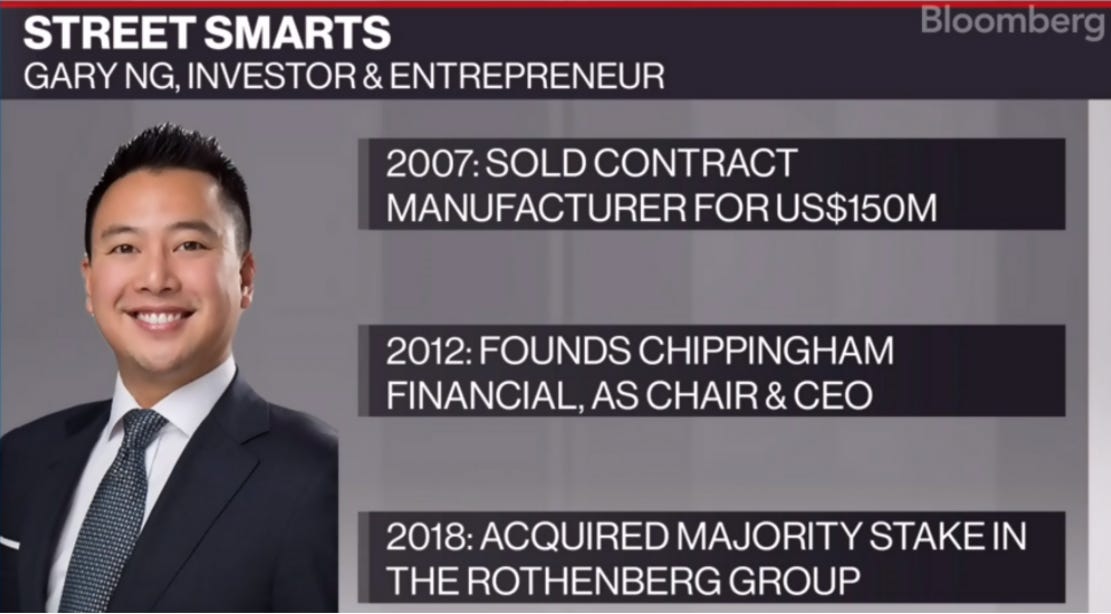

Many of you have written to complain that my last post on Gary Ng failed to deliver my brand promise of Kompromat-induced Schadenfreude™. Even some close colleagues of Gary Ng don't know how exactly he got rich so young. Rich enough to buy PI Financial for $100m at age 34. Here's how BNN Bloomberg introduced him:

Highly reliable Bloomberg wrote that Gary made his first million from working for Redknee during the dotcom bubble and then expands on his big 2007 score thusly:

"He says he plowed that into a Chinese glass factory that was eventually sold to Industrial Bank of China, giving him a US$150 million windfall."

This claim is all the more remarkable considering that 2007 was also the year he graduated with a BComm (Honors) from the University of Manitoba. He would have been around 23 years of age at the time. And he wasn't just any ordinary student. In 2006, just one year prior to the big $150 million sale, he graduated with a degree in Electrical Engineering. An April 2005 profile of him in a student publication mentions he has won scholarships and citizenship awards, worked on numerous telecom projects with major companies in several countries, that he's active with student bodies, that he tutors math on Saturdays, coaches badminton, volunteers with four charitable organizations and has written a book. But that article does not mention any involvement with that Chinese contract manufacturer. I guess it’s possible that in between student society meetings and volunteering with the Alzheimer Association, he found the time to own a US$150m concern in China.

So in 2007, he has a US$150m windfall, graduates from university with two degrees and an impressive resume. Then he claims to have spent months perfecting his golf score, the implication being that he was very rich. Then in February 2008, he joins Union Securities. I would have thought that if you had a $150m windfall and Gary's track record as an overachieving student, you would set your sights a little higher than Union Securities, forgive me for saying so.

In September 2019, he was reported as “working on four acquisitions”, but I haven’t seen any news on that front. There are industry rumors that PI Financial is for sale, but repeating that falls below even my very low journalistic standards.

Gary surely has a lot of legitimate money, otherwise, how is he paying for the acquisitions and getting approved as an owner of highly regulated businesses? The only question is how exactly he got that money. I regret that in this instance, I can only deliver some innuendo-based schadenfreude.